All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Multi-year ensured annuities, also recognized as MYGAs, are dealt with annuities that lock in a secure rates of interest for a defined time period. Give up durations typically last three to 10 years. Because MYGA prices change daily, RetireGuide and its partners update the following tables listed below regularly. It's crucial to check back for the most current details.

A number of elements determine the rate you'll get on an annuity. Annuity prices often tend to be greater when the general level of all rate of interest is greater. When buying repaired annuity prices, you may discover it useful to contrast prices to certificates of deposit (CDs), an additional popular choice for secure, reliable growth.

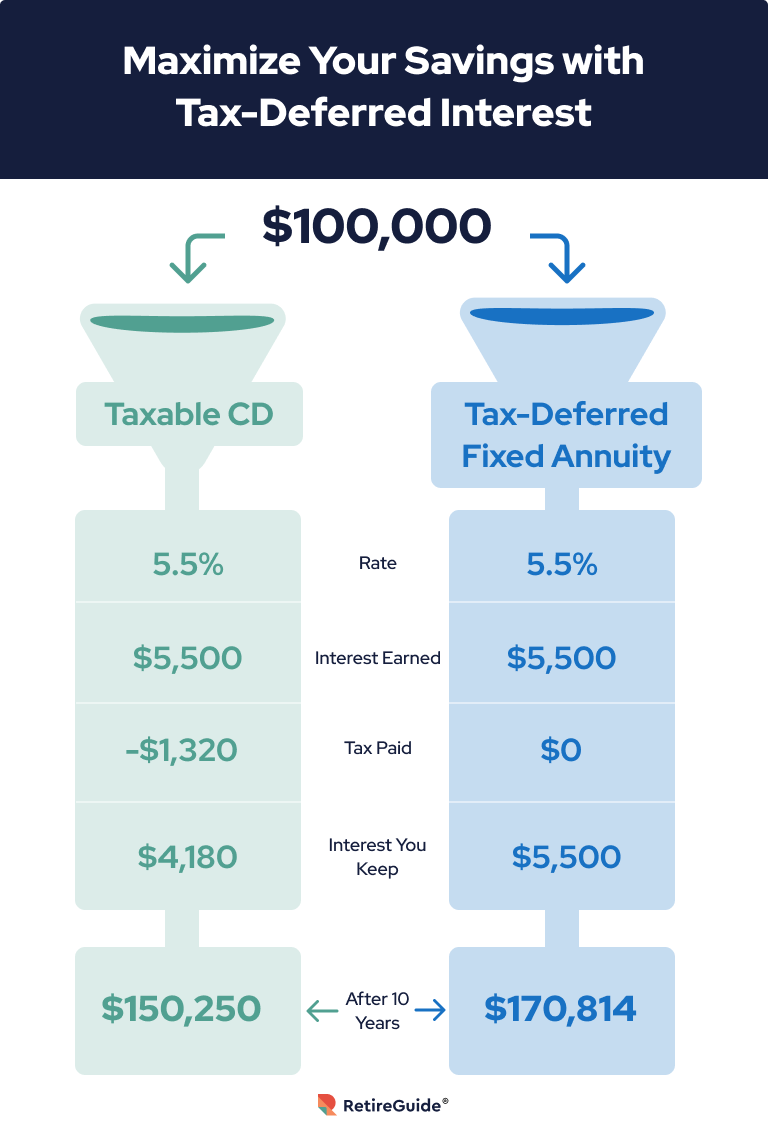

As a whole, fixed annuity rates outmatch the prices for CDs of a similar term. Other than earning a greater price, a taken care of annuity might provide much better returns than a CD since annuities have the benefit of tax-deferred growth. This indicates you will not pay tax obligations on the rate of interest gained up until you start getting repayments from the annuity, unlike CD interest, which is counted as gross income each year it's gained.

This led many professionals to think that the Fed would certainly reduce prices in 2024. At a policy forum in April 2024, Federal Book chair Jerome Powell recommended that rates might not come down for some time. Powell said that the Fed isn't certain when rates of interest cuts could take place, as inflation has yet to fall to the Fed's standard of 2%.

Tiaa Annuity Payout Options

Keep in mind that the very best annuity rates today may be different tomorrow. It is very important to talk to insurance policy firms to confirm their details prices. Start with a complimentary annuity assessment to discover just how annuities can help money your retirement.: Clicking will take you to our companion Annuity.org. When contrasting annuity prices, it is necessary to conduct your own research and not entirely choose an annuity simply for its high rate.

Take into consideration the kind of annuity. Each annuity type has a different range of ordinary rate of interest. For instance, a 4-year fixed annuity might have a greater rate than a 10-year multi-year guaranteed annuity (MYGA). This is since dealt with annuities may provide a greater rate for the first year and afterwards reduce the price for the remainder of the term, while MYGAs assure the rate for the entire term.

The assurance on an annuity is only comparable to the company that provides it. If the firm you buy your annuity from goes damaged or bust, you can lose cash. Check a firm's economic toughness by speaking with across the country recognized impartial rating companies, like AM Finest. Most professionals advise just taking into consideration insurance firms with a score of A- or above for long-lasting annuities.

Annuity earnings rises with the age of the purchaser since the income will certainly be paid out in less years, according to the Social Protection Management. Do not be stunned if your price is greater or lower than another person's, also if it coincides item. Annuity prices are simply one aspect to consider when buying an annuity.

Recognize the fees you'll need to pay to provide your annuity and if you need to cash it out. Squandering can set you back up to 10% of the value of your annuity, according to the Wisconsin Office of the Commissioner of Insurance. On the other hand, administrative fees can include up with time.

Firemen's Annuity And Benefit Fund Of Chicago

Rising cost of living Inflation can consume your annuity's value with time. You can consider an inflation-adjusted annuity that improves the payments in time. Understand, however, that it will significantly minimize your initial payouts. This indicates much less cash early in retirement but even more as you age. Take our complimentary quiz & in 3 simple steps.

Scan today's checklists of the finest Multi-year Guaranteed Annuities - MYGAs (updated Thursday, 2025-03-06). For professional help with multi-year assured annuities call 800-872-6684 or click a 'Obtain My Quote' button following to any kind of annuity in these lists.

Delayed annuities allow an amount to be taken out penalty-free. Deferred annuities generally enable either penalty-free withdrawals of your earned passion, or penalty-free withdrawals of 10% of your contract value each year.

The earlier in the annuity period, the higher the penalty portion, described as surrender charges. That's one reason that it's ideal to stick to the annuity, as soon as you commit to it. You can draw out whatever to reinvest it, yet before you do, ensure that you'll still prevail by doing this, also after you figure in the surrender charge.

The abandonment charge can be as high as 10% if you surrender your contract in the very first year. An abandonment charge would be charged to any kind of withdrawal higher than the penalty-free amount enabled by your delayed annuity contract.

Once you do, it's best to see it with to the end. Initially, you can set up "systematic withdrawals" from your annuity. This suggests that the insurance provider will certainly send you payments of interest monthly, quarterly or yearly. Using this technique will certainly not use your original principal. Your other choice is to "annuitize" your deferred annuity.

North American Annuities

Many delayed annuities enable you to annuitize your contract after the very first contract year. Passion made on CDs is taxable at the end of each year (unless the CD is held within tax obligation professional account like an Individual retirement account).

The passion is not exhausted until it is gotten rid of from the annuity. In various other words, your annuity grows tax deferred and the passion is compounded yearly. However, contrast purchasing is always a great idea. It's true that CDs are guaranteed by the FDIC. However, MYGAs are guaranteed by the individual states generally, in the array of $100,000 to $500,000.

Leads For Annuities

Either you take your cash in a swelling sum, reinvest it in one more annuity, or you can annuitize your contract, converting the swelling sum into a stream of earnings. By annuitizing, you will just pay tax obligations on the rate of interest you obtain in each settlement.

These features can vary from company-to-company, so make sure to explore your annuity's survivor benefit attributes. There are several advantages. 1. A MYGA can suggest reduced tax obligations than a CD. With a CD, the passion you make is taxed when you earn it, also though you don't obtain it until the CD matures.

At the very least, you pay tax obligations later on, instead than faster. Not just that, but the compounding passion will be based upon an amount that has actually not currently been strained. 2. Your recipients will certainly receive the complete account worth since the date you dieand no abandonment costs will certainly be deducted.

Your beneficiaries can pick either to obtain the payout in a round figure, or in a series of revenue repayments. 3. Frequently, when someone dies, also if he left a will, a court determines that gets what from the estate as sometimes family members will argue about what the will means.

With a multi-year set annuity, the proprietor has actually plainly designated a recipient, so no probate is called for. If you add to an IRA or a 401(k) strategy, you receive tax obligation deferral on the incomes, simply like a MYGA.

Latest Posts

Clear Spring Life And Annuity

Genworth Annuity Forms

Usaa Immediate Annuity Calculator